Cranking up the thermostat and switching on the lights is an automatic response for many of us attempting to stave off the chill in the air and prolonged hours of darkness winter brings.

But for European businesses and citizens alike, the economic impacts of the current energy situation might make keeping the furnace and lights on a privilege as the change in season approaches, and more importantly, the following winter.

In 2021, Russian exports accounted for 39% of the natural gas imported from non-EU countries. In light of the Russian invasion of Ukraine and subsequent sanctions from the west, Europe’s reliance on Russian natural gas has slowed to a trickle.

In response, the European Union established minimum storage targets for each member state: 80%. of storage capacity must be full before winter hits. As of early October, these targets have been exceeded, with the total gas storage capacity hovering at just under 90%.

Despite the numbers, experts say Europe could still be in for a tough winter. John Kemp, a market analyst for Reuters, told Al Jazeera that stockpiling natural gas is far from a fix-all for Europe’s energy needs throughout the winter.

Also considering if the situations in Europe do not improve throughout next year, the winter of 2023 could be even worse.

“Storage is intended to deal with seasonal variations in consumption, not provide a strategic reserve in case of an embargo or blockade,” said Kemp. “In the event of a complete cessation of imports from Russia, a colder than normal winter, or both, gas would become scarce before the end of March 2023.” And both suggestions from Kemp are plausible, if not likely. Russia shut down Nord Stream 1, the largest pipeline carrying natural gas into Europe in August, citing maintenance issues as a result of sanction imposition.

In the following weeks, multiple leaks were detected in Nord Stream pipelines 1 and 2, at which Swedish investigators have found evidence of explosions. Investigators have voiced “suspicions of serious sabotage.”

Reuters reported predictions from the European Centre for Medium-Range Weather Forecasts, which indicated a potential cold spell in December – a forecast likely to result in increased energy use, as seen in Germany when a late September cold snap resulted in a 14.5% spike in German household and small business natural gas use.

But European forecasts are not the only important weather predictions to consider. In the process of reaching the EU’s natural gas storage targets, European countries have been buying gas from a large variety of markets – and they aren’t the only buyers interested.

Leon Izbicki, an analyst for Energy Aspects, says it’s important to consider the interests of competition when entering new markets.

“Demand for LNG [liquefied natural gas] in Asia is going to be critical as a determining factor for how much energy Europe can actually get over the course of this winter.” Meaning if Asian countries also have cold periods resulting in increased energy use, demand for non-Russian natural gas will be high and supplies will be spread thin.

In order to combat high energy use running natural gas reservoirs low, European governments have implemented caps on electricity, necessitating a 5% reduction in power use during peak hours.

However, for many businesses, further cutbacks, curbs, and caps on energy use could spell devastation. According to U.S. News & World Report, businesses are already feeling the sting of power use regulation.

“We can’t turn off the lights and make our guests sit in the dark,” said Richard Kovacs, manager of business development for Zing Burger, a Hungarian-based burger chain. Kovacs said grills are only run as necessary and sections of restaurants use motion-sensor lights, but some locations have already seen an almost 800% increase in power costs this year.

Greenhouses in the Netherlands producing smaller batches of produce, and bakers in Germany limiting patisserie variety and oven use are only a few examples of how energy cutbacks will affect businesses in Europe. And while power bills continue to rise, many small businesses might not have the longevity to wait out the storm.

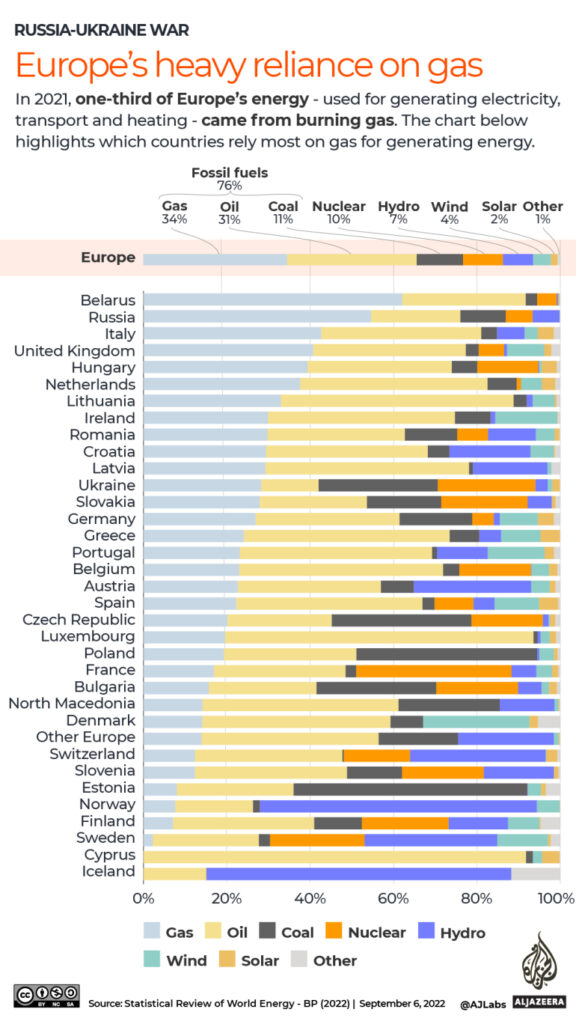

So what does this bleak assessment of Europe’s energy security mean? In short, it signals time for change. Many European countries are heavily reliant on natural gas for energy production; Belarus derives 62% of its energy from gas, Italy 42%, followed closely by the U.K and Hungary at 40% and 39% respectively.

As depicted in the graphic above, the continent of Europe gleans less than 25% of its energy from renewable sources, with geothermal energy categorized in the smallest bracket of ‘other,’ totalling around 1% for the entire continent.

A recent study featured in the scholarly journal Energy estimated the potential for geothermal production in Europe to account for between 4 and 7% of the continent’s energy production by 2050.

While this projection signals the potential for a large jump in geothermal output, the study was limited to exploration of traditional geothermal technology.

Eavor’s innovative closed-loop technology bypasses many obstacles faced by conventional geothermal techniques, such as subterranean temperatures that are too low to produce steam or geologic conditions unsuited to traditional geothermal drilling. Eavor technology can be implemented in a range of conditions, broadening the scope for green, renewable energy.

With the widespread implementation of the revolutionary Eavor-Loop™ across Europe, geothermal energy has the potential to exceed the predictions of 4 to 7% of Europe’s energy and heat generation, and possibly even contribute to the stabilization of an increasingly precarious and ever-changing energy industry – much sooner than you might think.

On October 31, Eavor announced the official start of a new project in Geretsried, Germany. The first commercial project of its kind, the repurposed geothermal plant will provide district heating for local communities.

Using heat extracted through Eavor-Loop™ technology, residential and commercial dwellings in the surrounding areas will no longer rely on natural gas combustion for heating needs, greatly reducing the hit to vital natural gas stores – especially during cold spells.

Lessening the strain on energy storage is just one of the benefits of applying Eavor’s innovative technology in a transitioning energy market. The European Union has set net-zero climate targets for 2050, and significant greenhouse gas emission reduction targets for 2030.

As part of the European Green Deal, and commitment to the Paris Agreement, the EU and member states are also aiming to increase energy efficiency by 32.5%, and bump up the market share for renewable energy to at least 32%.

Critics of the net-zero carbon push are in no short supply, citing the need for fast action instead of long-term goals. But with the revolutionary technology produced and patented by Eavor, Europe – and the rest of the world – can have both; real-world action now, in order to write a cleaner, greener chapter for our earth.