2022 proved to be a fruitful year for European venture capital funds, according to an article by Amy Lewin and Sadia Nowshin of Sifted.eu.

Last year, more than €23.3 billion was raised by both established and up-and-coming venture capitalists. Unsurprisingly (but nonetheless encouraging), funds and firms are eyeing climate tech projects and start-ups as promising and politically prioritized investments.

The European Union has committed to reducing emissions by 55% from 1990 levels by the end of the decade, and becoming the world’s first net-zero continent by 2050.

Other European nations outside the EU have their own climate goals, including the United Kingdom, Turkey, Switzerland, and Norway.

These commitments spell more than just positive change for the environment. For venture capitalists, they signal the start of a new global industry in need of financing now, with the potential for exponential returns in the future.

Of their curated list of more than 50 European venture capital funds, Lewin and Nowshin identified 7 firms with over €100 million to invest in climate tech.

Una Terra Venture Capital, based out of Zurich, Switzerland, has already invested €10 million into 6 different companies focused on the energy transition and sustainability.

U.S.-based Energy Impact Partners has raised €390 million to invest in late-stage companies working towards net-zero technologies in Europe. Average investment totals will range from €10 million to €35 million for each partner.

Kiko Ventures is a new UK Evergreen fund started in June 2022 with €375 million to commit over the next five years to climate tech advancement. Notable headings in Kiko’s portfolio include nuclear fusion, CO2 capture, and hydrogen fuel cell technology.

To read the full list of climate tech-focused firms and other eminent venture capital funds in Europe, click here.

Other intriguing venture capital funds mentioned in the article include Climentum and Urban Impact Ventures. With offices in Copenhagen, Berlin, and Stockholm, Climentum is focused on financing climate tech hardware with the potential for extreme and unignorable impact.

Urban Impact Ventures is headquartered in Rotterdam and is geared toward the sustainable transformation of cities with decarbonization technology and a focus on the circular economy an economic model of reuse and regeneration.

These venture capitalists don’t have to look far to find green-tech European projects needing financial support. The European Innovation Fund has a portfolio of projects from carbon capture and clean concrete to renewable energy start-ups, and the site also hosts a list of projects in various stages that have qualified for the Fund’s Project Development Assistance Plan.

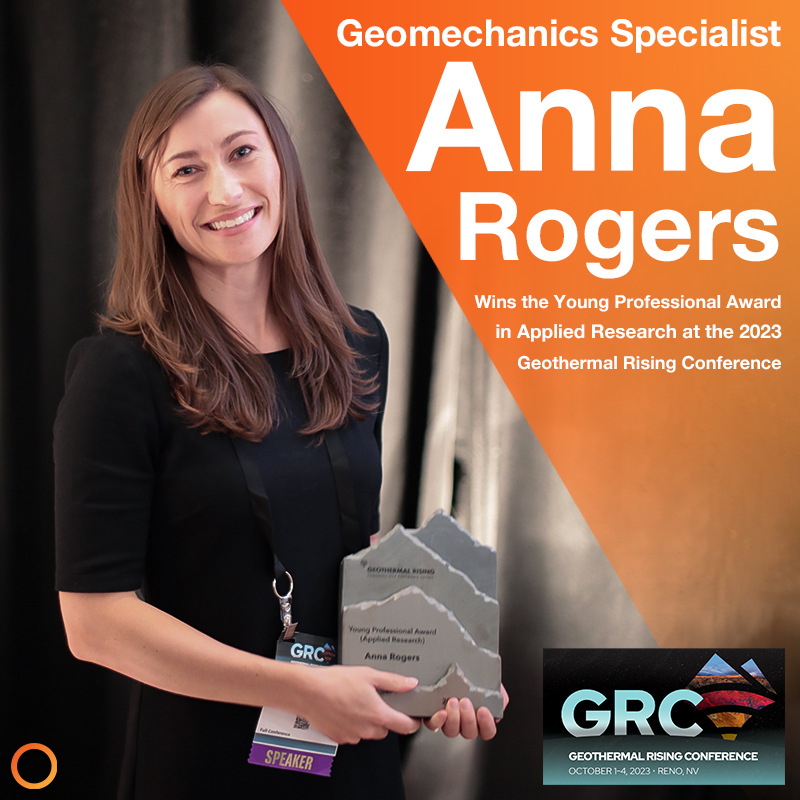

And Eavor’s first commercial closed-loop geothermal plant is certainly on the roster of climate tech projects in search of investments. Announced in October 2022, the project is a re-purposing of a failed traditional geothermal plant in Bavaria, Germany, and will supply surrounding communities and businesses with district heating.

The project made the short-list for the European Innovation Fund after two selected projects did not follow through on the grant agreement process. Eavor was invited to prepare a grant agreement on December 19, 2022, marking it as a major player in the advancement of climate tech and the journey to a net-zero world. Stay up to date on our blogs to hear more about new funds and partnerships in Europe and around the world.